r&d tax credit calculation example uk

To find out more RD Tax Credit Project Examples for your industry or to learn more about what the RD Tax Credits. 100000 x 230 230000 uplifted.

Small Business Tax Credits The Complete Guide Nerdwallet

The RD Tax Relief for UK small and medium-sized enterprises SMEs has the same calculation for all companies applying to the program but your companies corporation tax has an effect on.

. Loss-Making SME Calculation Example 1. If in 2022 a to z construction had qualified research expenses of 70000 they would calculate the available. Deduct the RD enhanced expenditure within the tax computation.

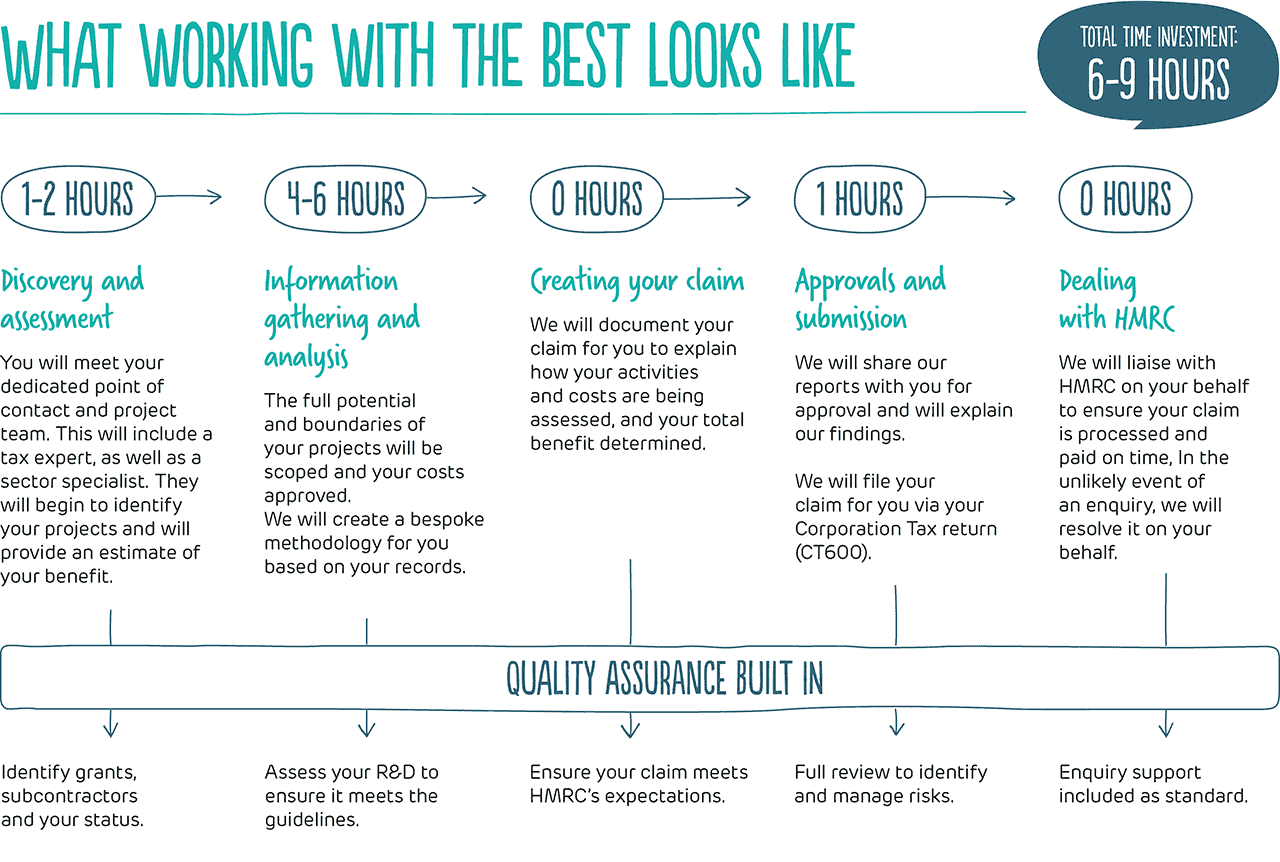

Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. The next step is easy. It was increased to.

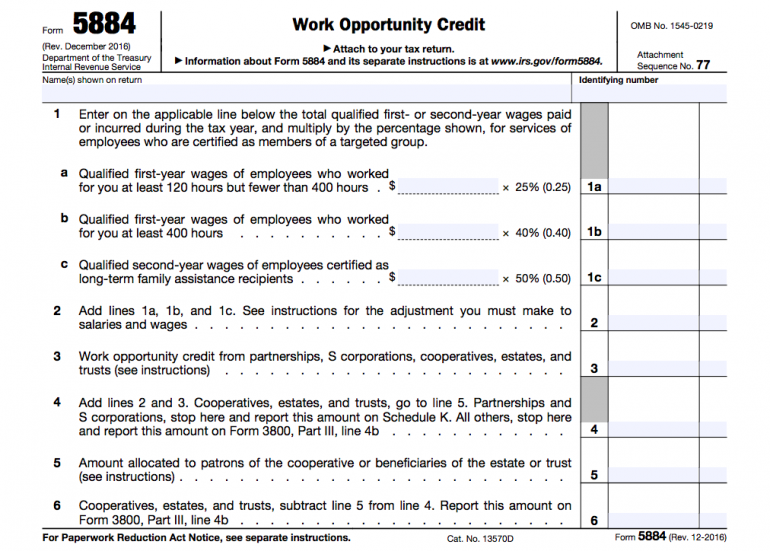

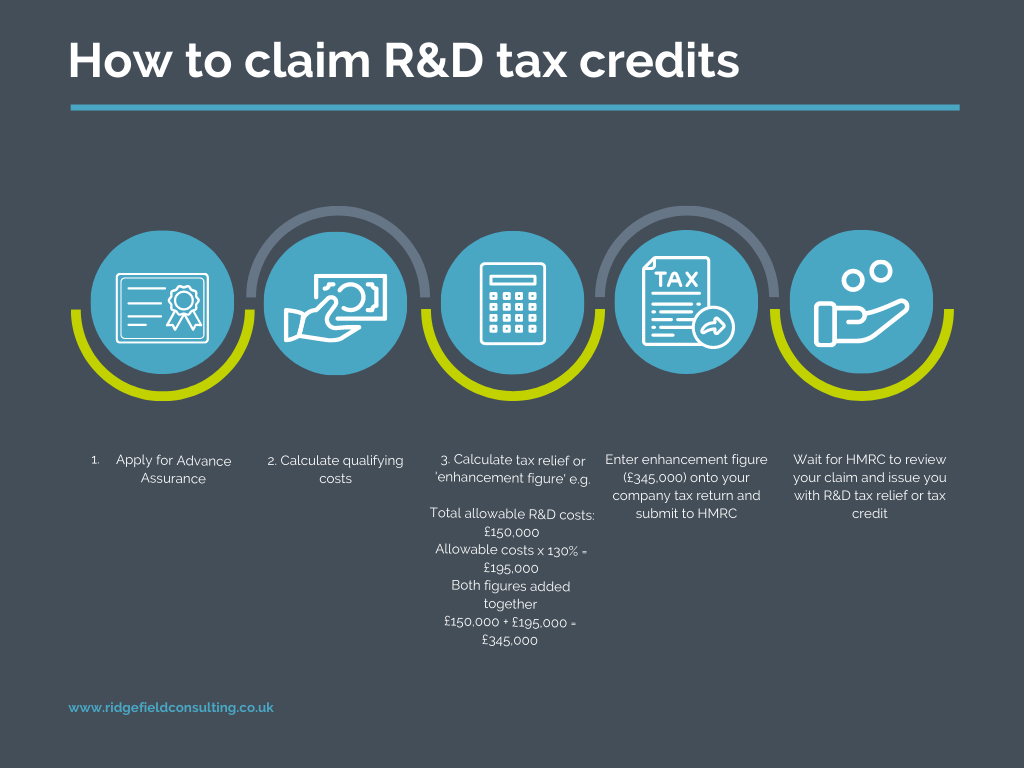

The qualifying expenditure is 100000 thats already in accounts as expenditure. The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable as trading income. Select either an SME or Large.

SME Scheme calculation for a company that was profitable and spent 100000 on qualifying RD activities in a given year. The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017. The RD Tax Relief scheme allows a further deduction to be made calculated as 130 of the qualifying expenditure identified.

The notional additional 130 RD tax deduction is deducted within the company tax computation. RD tax credit calculation examples MPA from mpacouk. RD Tax Credit Calculation Examples.

First however the fix-based percentage must be obtained by. You take 50 or half of this amount which is 40000. Say our example SME made a loss of 300000 for the year with the same 100000 RD QE and chose to surrender losses and claim relief.

The credit is calculated at 13 of your companys qualifying rd expenditure. For profit-making businesses RD tax credits reduce your Corporation Tax bill. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount.

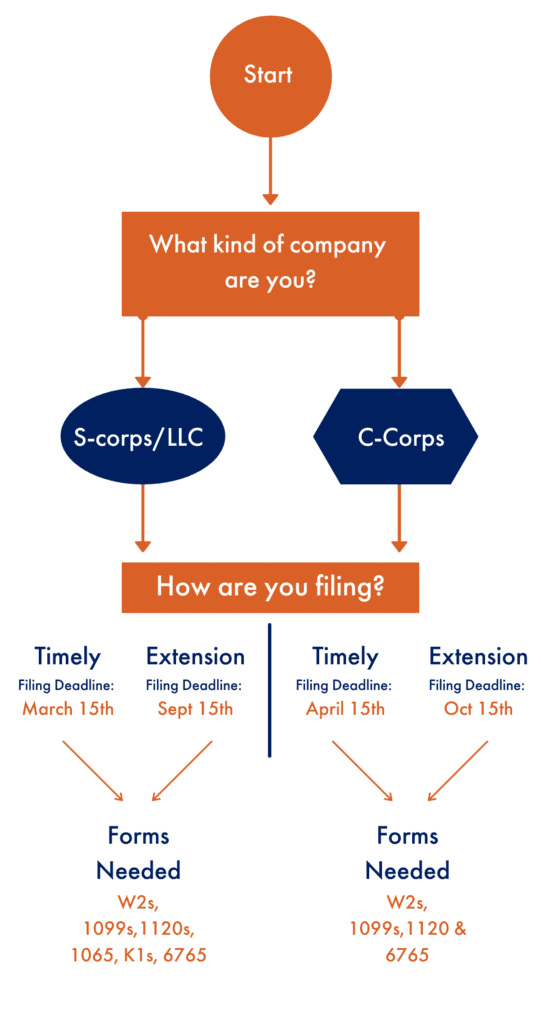

The calculation of your RD tax relief benefit depends on the companys situation whether it falls into the category of-. 12 from 1 January. The next step takes the current year expenditures of 95000 and subtracts the 40000 three-year.

100k QE in this example. Enhance your QE by multiplying by 130. The notional additional 130 rd tax deduction is deducted within the company tax computation.

Just follow the simple steps below. Below are the various examples of how a claim value is calculated. Company X made profits of 400000 for the year calculate the RD tax credit saving.

R D Tax Credits A Guide To Eligibility Claim Preparation And Calculation

Claiming R D Tax Credits For Your Manufacturing Business

Insight 2017 Tax Law Changes Increases Value Of R D Tax Credit

R D Tax Credit Qualified Expenses Adp

How To File A R D Research And Development Tax Credit Claim Easy Digital Filing

R D Tax Credits Explained Are You Eligible What Projects Qualify

R D Tax Credits Uk What Is It How To Claim Capalona

Is It Too Late To Claim The R D Tax Credit In 2021 Leyton Blog

Research Development R D Tax Credits Faqs Bdo

Self Prepared R D Tax Credit Claims What Are The Risks

How To Claim R D Tax Credits R D Accountants For Oxfordshire

Tax Credit For Increasing Research Activities Tax Services Cla Cliftonlarsonallen

R D Tax Subsidies In Oecd Countries Tax Foundation

How To Calculate R D Tax Credits With Examples Kene Partners

R D Tax Credit Calculation Examples Mpa

How To Calculate R D Tax Credits With Examples Kene Partners

![]()

R D Tax Credits Can Save Your Business Hundreds Of Thousands Uhy

R D Tax Credits Explained Are You Eligible What Projects Qualify